Bridging the Disconnect: The Overwrought Tale of the U.S. Regulators and the Crypto Industry

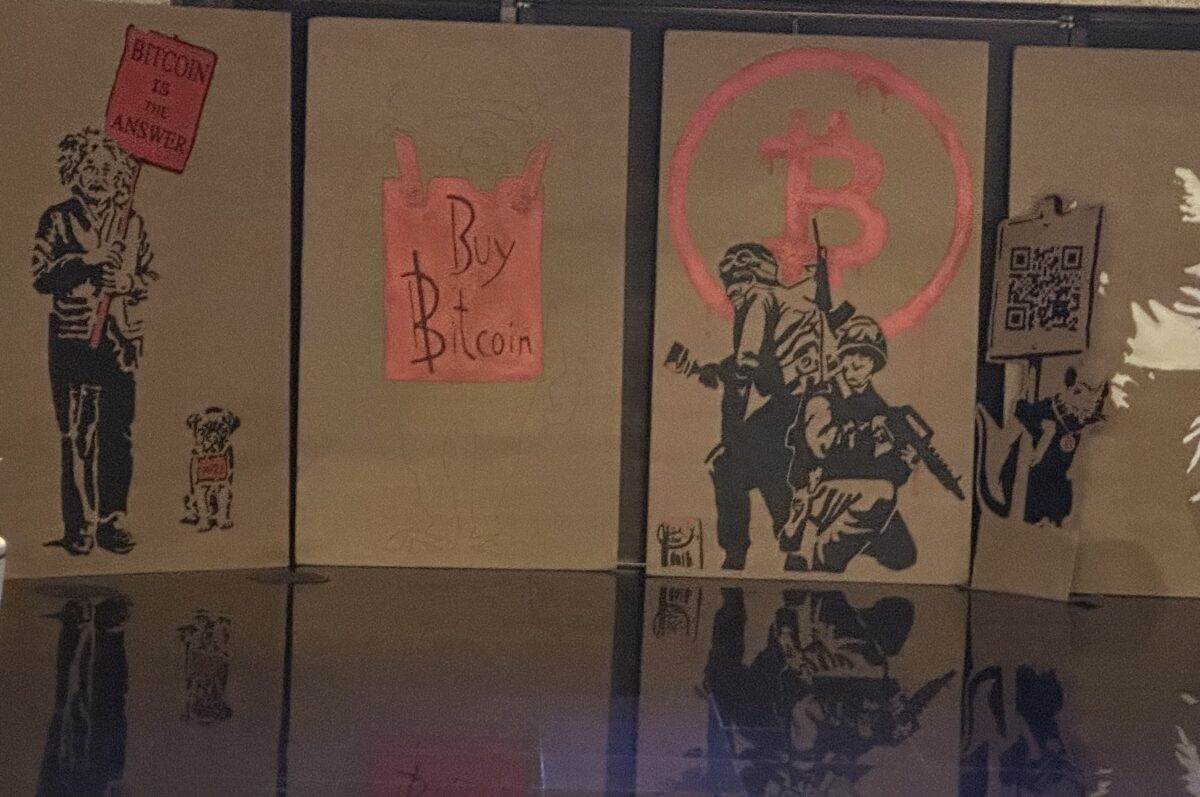

Image: Anonymous Bitcoin Artist at European Blockchain Convention, February, 2023

The crypto industry, with its rapid rise, coupled with its innate volatility, has been a significant topic of discussion in financial spheres, even prompting mainstream interest over the last few years. While momentum continues to build, regulators worldwide grapple with the challenge of adequately understanding and regulating this nascent sector.

While other countries and jurisdictions have put forth regulations and proposals, the United States, as we’ve discussed in the past, continues to lag.

At this time, the U.S. has two primary regulatory bodies involved in the oversight of the crypto space: the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Gary Gensler, a former professor at MIT’s Sloan School of Management renowned for his expertise in blockchain and cryptocurrency, has made headlines for his distinctive approach to the crypto industry.

However, there’s a palpable disconnect that warrants a closer look.

The SEC, CFTC and crypto: a regulatory conundrum

The regulatory landscape for cryptocurrencies in the U.S. is muddled, primarily because the SEC and CFTC view cryptocurrencies differently. The SEC often considers digital assets as securities, hence under their purview, while the CFTC views cryptocurrencies like Bitcoin as commodities, thereby falling within their jurisdiction.

This divide has led to regulatory uncertainty, leaving crypto businesses unsure of compliance requirements. Consequently, fear and hesitation pervade the market.

Since assuming the role of SEC chair in April 2021, Gensler has raised some eyebrows for his skeptical outlook on the crypto industry – despite his extensive knowledge of the technology. Gensler’s emphasis on safeguarding investors and upholding market integrity has been viewed by certain members of the crypto community as excessively strict and possibly impeding innovation.

The disconnect

The main disconnect arises from the perception that the regulators, led by Gensler, are implementing traditional regulatory frameworks in a non-traditional, highly innovative sector.

Crypto enthusiasts argue for balanced regulations, taking into account the unique characteristics of cryptocurrencies and blockchain technology.

Moreover, Gensler’s assertion that most cryptocurrencies qualify as securities has sparked controversy. Many in the crypto industry believe that this broad classification can stifle revolutionary technology and what is deemed by enthusiasts as “permissionless” by imposing restrictive securities laws on nascent blockchain projects.

The need for smart regulation

While the concerns of the crypto industry are valid, even the diehards understand the need for smart regulation. The crypto market – characterized by its volatility, anonymity and decentralization – presents various risks including market manipulation, fraud and investor protection issues.

We all experienced 2022, with its schemes, rug pulls and other lecherous happenings. The right regulations can indeed help mitigate these risks, establish long-term market integrity and protect investors.

However, the crux of the matter lies in the implementation of intelligent regulation—a regulatory framework that effectively balances the promotion of innovation with the mitigation of risks. This can be accomplished by developing flexible and adaptable regulations that acknowledge the distinctive characteristics of cryptocurrencies and blockchain technology.

Smart regulation is not about imposing restrictions. Rather, it’s about understanding the nuances of the industry and developing rules that adapt to its innovative nature. It’s about creating an environment where the transformative potential of blockchain technology and cryptocurrencies can be fully realized – while also safeguarding the interests of investors and the broader financial system.

Moving forward

There’s a need for continued, constructive dialogue between regulators and the crypto industry to bridge this disconnected, fractured relationship. We must keep pounding the pavement about the importance of this matter. Regular engagement within the industry can help regulators understand the industry’s concerns, while also allowing the crypto sector to better understand the regulators’ perspective.

Furthermore, regulatory clarity is crucial. Clear guidelines from the U.S. on the regulatory treatment of different types of digital assets can provide the certainty businesses need to operate confidently and innovate. In turn, this clarity can help settle fear in the market.

Gensler, with his background in blockchain and cryptocurrencies, is well placed to lead this charge. He is playing a pivotal role whether it is one he wants to play or not. He can bridge the gap between TradFi and crypto. He has the unique and once-in-a-lifetime opportunity to foster an environment where the crypto industry can thrive, while also ensuring that the interests of investors and the broader financial system are protected.

A call to action

As we look towards the future, it’s clear the crypto industry is set to play an increasingly significant role in our global financial system. As such, it’s more important than ever that regulatory bodies and industry leaders work hand-in-hand to navigate this new frontier.

The current disconnect between the SEC, CFTC, Gary Gensler and the crypto industry is not insurmountable. As we move forward, it is incumbent on all stakeholders to embrace this challenge. The crypto industry, regulators and policymakers must come together to shape a regulatory framework that balances the need for innovation with the necessity of investor protection.

This is not just about easing fear in the market. It’s about shaping the future of finance.

In conclusion, the discord between the SEC, CFTC, Gensler and the crypto industry is a call to action – signaling collaboration, understanding and smart regulation.

Today, landmark crypto legislation Markets in Crypto Assets, known as MiCA, took a big step forward, with European Parliament lawmakers giving final approval from member states. MiCA is expected to begin taking effect in phases beginning July, 2024. Now is the time for the U.S. to move forward in a meaningful way.

By answering a call to action – similar to what the European Parliament lawmakers have done – the U.S. can also foster a vibrant, safe and innovative crypto industry, one which benefits all stakeholders and stands as a testament to the transformative potential of blockchain technology.